Our Speciality

Ameritime® is a knowledgeable collective of former educators who work in tandem with an Integrated Financial Network® to inform and assist fellow Missouri educators about their money and their financial future. Since 1989, Ameritime has successfully managed to navigate the often times confusing regulations and benefits of the Missouri Public School Retirement System. We know the gravity these benefits hold for educators and their families, and are determined to share our experience, knowledge and expertise with any and all other Missouri educational employees.

Over the past 30 years, we have met with thousands of teachers, coaches and educational professionals across the state, and developed financially beneficial strategies that help PSRS/PEERS members maximize their pensions. We feel that when educators understand there are creative ways to achieve this goal with glowing rewards, they will be in a position to more comfortably and efficiently control their cash flow and overall wealth. Our ultimate goal is to make it possible for our clients to retain and utilize their current earnings to their advantage, and pass on more of their wealth to future generations.

MO Public School Retirement System Updates

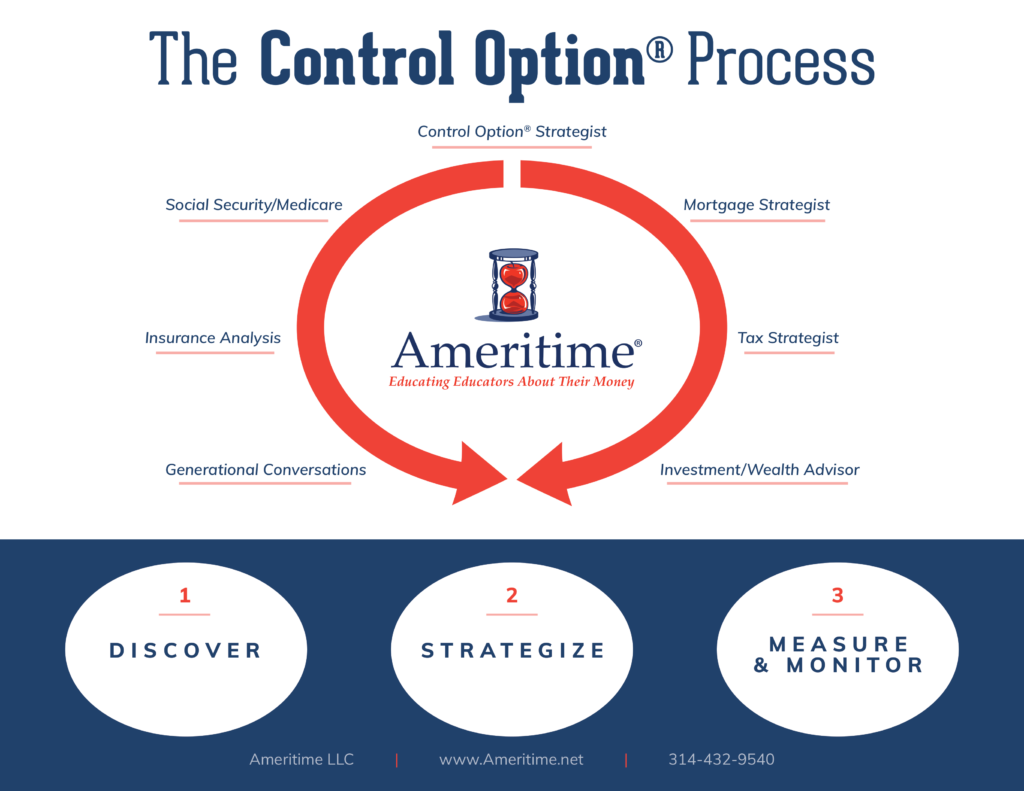

The Ameritime® - The Control Option® Process

At Ameritime we guide each of our clients through a unique, three-phase process specifically designed for educators in the Missouri PSRS/PEERS retirement system. When an educational professional is navigated through this process, they will learn unique ways to maximize their pension in a way that may exponentially benefit them and their families.

Discovery Phase

The initial part of the Discovery Phase is designed to explore the different facets of the PSRS/PEERS retirement system by reviewing the following:

- Full retirement benchmarks and benefits

- Early retirement benchmarks and benefits

- Partial Lump Sum Option (PLSO)

- Effects PSRS will have on Social Security benefits

- Survivorship Options

- Can you buy time? Does it make sense?

- Potential monthly benefits in retirement

The second part of the Discovery Phase consists of completing what we refer to as a “Financial Discovery” on an educator’s current economical status. The Financial Discovery was developed to act as a visual tool for a designated Ameritime® team that can then present the educator with a financial picture to help them think through their retirement. This way we can begin to strategize the best options for the most beneficial retirement package available. Because there are so many variables and different things to consider when choosing benefits, we need a client’s full financial picture to ensure that we select the most fitting and lucrative options for each specific educator.

Once we’ve completed Discovery, and the client is ready to move forward after feeling confident with all of their pension options, we usher them on to the next phase… Strategy.

Strategy Phase

In the Strategy Phase we introduce our Integrated Financial Network (IFN) as needed to handle and maximize the educator’s pension benefits. This process will help the client gain more control of their cash flow, minimize taxes and ultimately create long-term financial stability for not just them, but future generations as well. When implementing this process, we focus on the following facets of the client’s financial picture:

- Generate a maximum pension check with a tax-free survivor benefit

- Create more cash flow each month in retirement

- Grow assets in the most tax-efficient manner

- Minimize tax liability throughout retirement

- Design the most effective ways to handle debt obligations

- Transfer assets to the next generation most efficiently

By utilizing these strategies crafted specifically for the educator by our IFN®, this phase ultimately results in additional financial comfort, stability and peace of mind. The client and their loved ones will potentially enjoy more wealth during their lifetime, and subsequently more to pass on to help secure the future of the next generation.

The final phase is a long-term monitoring plan designed specifically for each client, aptly named the…

Measure and Monitor Phase

So based on the educator’s financial picture, we have knocked out discovery and strategy. The next step is to forge ahead into the long-term Measure and Monitor Phase. First, we initiate a meeting with the educator once a year for an annual review of their Financial Picture. This allows the client to touch base with, and really get to know, their personalized integrated financial team.

Of course, the educator always has the option to meet with their Ameritime Team before the scheduled annual meeting. We realize that specifics in a financial picture can shift dramatically, and we are readily available at any time to address any significant changes that may occur.

The Measure and Monitor phase consist of the following:

- Meet on an annual basis to review the client’s financial picture

- Update the client’s cash flow, assets and taxation

- Look for new ways to help enhance the client’s financial picture

- Our IFN ensures everything planned and discussed is currently going smoothly

Contact Ameritime to Schedule a Complimentary Meeting

Integrated Financial Network®

What’s that? Glad you asked.

Ameritime’s Integrated Financial Network® (or IFN®) is an accomplished, experienced team of financial professionals who specialize in the Missouri Public School Retirement System. We work for you, exclusively.

Our network essentially provides a one-stop-shop for Missouri educators that offers expert advice on their complete financial picture. In the confusing world of retirement lingo and loopholes, our IFN® is uniquely dedicated to helping MO educators not only understand their options, but also positively impact their entire financial picture. Maximizing pensions, creating greater control over cash flow and wealth, smarter living prior to and during retirement and ensuring the financial success of our clients’ future generations are just some of the many things we do.

Once an educational professional teams up with Ameritime®, we can communicate with the professionals in the Integrated Financial Network® to ensure the most efficient methods of dealing with that educator’s financial needs. Our goal is to make the IFN® easy to obtain, navigate and utilize, eliminating typical frustrations that are often present when dealing with retirement planning… specifically in the field of education. Think of it as a way to coordinate all of your various independent money and financial services in one convenient place, with experts that know your exact situation.